Published on: Friday, Fri, 12 Apr 2024 ● 9 Min Read

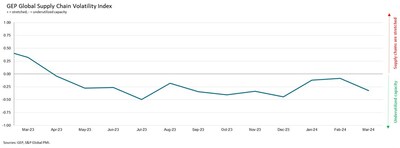

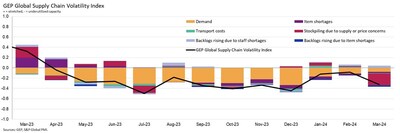

CLARK, N.J., April 12, 2024 -- The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — fell for the first time this year to -0.32 in March, from February's 10-month high of -0.08. While this does signal a pickup in the level of spare capacity at global suppliers, underlying data show this was due to global manufacturers using up inventory surpluses, some of which were accumulated because of Red Sea and Panama Canal disruptions, and cutting back on stockpiling activity, with companies displaying a preference to clear stocks before placing bumper orders with their vendors.

Continuing the year-to-date trend, demand for raw materials, commodities and components continued to recover in March. Notably, Asia was the primary driver of this improvement, led by India and China, with factories across the region boosting their purchases of inputs by the strongest degree since December 2021. Given Asia's importance to global production, this provides a strong indication of future growth for the wider manufacturing economy.

Notably, North American suppliers experienced difficulties in meeting orders, as backlogs of work due to a lack of staff increased. This suggests a strong pipeline of orders for the coming months.

In Europe, the slowest decline in input demand for a year provides evidence of the continent's industrial recession easing. However, the continued struggles of manufacturers in Germany remained a considerable drag.

Global transportation costs fell to their lowest level since last December as the diminishing impact of the Suez Canal disruption led container rates to decline. Our data shows no discernable impact to the world's supplies from either the Red Sea attacks or from reduced capacity on the Panama Canal, as businesses adjusted to longer delivery schedules.

"In March, orders placed with Asia's suppliers ramped up, which is a strong signal of accelerating growth in manufacturing in the coming months," explained Roopa Makhija, president and co-founder, GEP. "In North America, suppliers are reporting difficulties meeting orders due to staff shortages, signaling capacity constraints, even though input demand declined slightly. This does mean that manufacturers have strong pipelines which undermines the Fed's expressed desire to cut interest rates, at least in the near-term."

Interpreting the data:

MARCH 2024 KEY FINDINGS

REGIONAL SUPPLY CHAIN VOLATILITY

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, May 13, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 550 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global's prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information ("Data") contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers' Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings ("Content") in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers ("Content Providers") do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media Contacts

Derek Creevey

Director, Public Relations

GEP

Phone: +1 732-382-6565

Email: derek.creevey@gep.com

Joe Hayes

Principal Economist

S&P Global Market Intelligence

T: +44-1344-328-099

joe.hayes@spglobal.com

Photo - https://mma.prnewswire.com/media/2384947/GEP_Global_Supply_Chain_Volatility_Index_Graph_1.jpg

Photo - https://mma.prnewswire.com/media/2384950/GEP_Global_Supply_Chain_Volatility_Index_Graph_2.jpg

Logo - https://mma.prnewswire.com/media/518346/GEP_Logo.jpg